Role of Foreign Business Finance in Balance of Payments

- Image via Wikipedia

Countries like India could face a balance of payments issue with incessant foreign direct investments. In business finance, an unfavorable balance of payments situation is when a country’s external debt exceeds its income. Profitability is not an option for India, since it has to repay its debt, and also post an operating profit. Going on break-even mode for long, holds no value for any overseas business finance investments.

Balance of payments problems might surface directly or indirectly. When there is a large pool of foreign equity presence in Indian companies, then the balance of payment problem is direct. Also, if revenues after exports are not great, then the country has a negative business finance condition. Sometimes, emerging countries like India will buy international export licenses. Costing a lot, these licenses have to be renewed periodically and are subject to lots of terms and conditions. In situations where the basic raw materials are not available within the country, import has to take place. When all this gets out of hand, the business finance potential tilts in the other direction. A direct balance of payments deficit is indicated in these circumstances. Indirect balance of payments happen, when exports from emerging economies are not wanted, because a substitute was found for it in the importing country.

Nowadays, multinational companies invest in other countries by setting up subsidiaries, or branches. By doing this they are ensuring that they deal with the same products and services. What they also achieve is a reduction in operating business finance expenses. Looking at an export perspective, this does not offer a great business finance impetus to the host country. If the FDI is driven by reduction of operating costs, then more exports do not necessarily mean more money for the host country. If the FDI is driven by the reduction of production costs, then more exports will automatically take place from the host country.

Empirical evidences do not however substantiate the direct involvement of FDI in creating unfavorable business finance conditions in a country. However, over a long-term, self-sufficiency to a certain degree is always advised.

Revival Business Finance: The Indian Stimulus Package

- Image by Getty Images via@daylife

In 2008, the Indian government resuscitated the Indian economy back to life with a stimulus package to strengthen India’s business finance position. Deepening global financial meltdown influenced this act. Close to four billion US dollars was part of the stimulus package. By cutting down on miscellaneous expenses, and also on the repo rate, the government of India raised the internal demand for business finance.

Investors and businessmen were drawn into a sense of hope. Incentives were piggybacked on the stimulus package. To increase exports, over fifty million US dollars was chalked out as part of incentives. Cottage industries, where manual labor was more concentrated, became the beneficiaries of the stimulus package. Efforts such as these, gave the cottage industries operating business finance, and a fresh lease of life. Aimed to be an act of resuscitation, the stimulus package led to not only a revival, but also a revolution.

A stimulus package is a kind of revival business finance. Business finance when available more freely in the market has lesser demand-rigidity. So lending of it can be more liberal. When lending is liberal with regards to interest rates, there will be more takers. Money taken will be used to produce profits or income. Profits or income, become savings. Savings are kept in banks, or invested. Ultimately serendipity happens, leading to a favorable business finance condition.

The Indian government as part of its stimulus initiative, provided tax rebates on business finance for small and medium scale industries. Different products were identified to have a revision of their value added taxes. By doing this, the government increased the consumption of these products. By reducing Central Value Added Tax on cars, cement, and textile, the government ensured that people stopped to stop buying these commodities. Companies in housing, exports, power, automobiles, and infrastructure received a wave of fresh business finance through the stimulus package.

In 2008, the Indian economy was growing at around 6-7 percent. With the inclusion of the stimulus package, things changed. Fresh business finance created a sea of activity in the Indian economy. A new road was opened for India Inc.

Teaser Home Loans

- Image via Wikipedia

When there is too much liquidity in the market, some of it has to be taken off. Teaser Home loans do just that. A Teaser Home Loan is a kind of business finance that is given by the lending market to the borrowing market, when there is an excessive liquidity situation. To minimize the inactivity of the lending market, business finance is doled out as Teaser Home Loans. Economies use this as an accelerator to gain enough activity.

Attractive interest rates and easy payment options characterize Teaser Home Loans. Teaser Home Loans will even have waivers of interest rates. Interest rates might get back to original rates after the-honeymoon’ period. One might tend to think if this business finance model is inspired by the clothing retail market.

Teaser Home Loans will have interest rates a couple of notches below standard rates. Fixed rates might be for a specific period of time, post-which the borrower will have the option to switch to floating rates. In India, affordable housing is the next wave of real estate. Teaser Home Loans provide the perfect business finance option for banks to tap into the customer base of this market. Buyers of economical homes will always flock to the teaser loan avenue.

Banks will not always keep Teaser Home Loan schemes. From a business finance perspective, the viability of long-term Teaser Home Loans is not convincing. So banks usually offer Teaser Home Loans for a finite period of time. For example, the State Bank of India brought out a home loan scheme. 8 percent interest was charged in the first year, and 9 percent from then onwards. From the 4th year, loans lesser than or equal to fifty lakh rupees, was charged at 9.25 percent interest. This is an example of a teaser home loan. Existing customers felt that the Teaser Home Loan was only to attract new customers. Expressing their concerns to the Banking Codes and Standards Board of India (BCSBI), customers felt that the business finance model of teaser loan providers was not inclusive.

Derivatives

- Image via Wikipedia

In business finance, a derivative is a derived value of an asset. Shares, or currencies can be assets. Based on the derived value, a financial agreement is made between two parties. It is basically a forecasted price of an asset. Underlying is what the forecasted asset is called. In business finance, all derivatives are based on the forecasted value of the underlying.

Exchange-traded and Over-the-counter (OTC) are the two markets in which derivatives are traded. Exchange-traded markets are supported by the stock exchanges. Providing guarantee, stock exchanges minimize transactional risks in exchange-traded markets. Exchange-traded markets are controlled by centralized regulatory mechanism. Also, there are umpteen business finance traders in exchange-traded markets. Stock exchanges also want companies that offer exchange-traded derivatives to become their member through a registration process. In over-the-counter markets, all the above mentioned things are missing. OTC markets are private in nature. On OTC markets, the length of the contract can be mutually decided on.

Swaps, futures, and options are the common types of derivatives. Other types of derivates do exist, since forecasted business finance can be based on any kind of asset or security. Examples of other types of derivatives are foreign exchange derivatives, and equity derivatives. In business finance, futures is a contract between two parties to trade an asset on a future date. Price for the asset will be as of today. The same price will be applicable on the future date of trade. Futures are traded on the futures exchange. The futures exchange is a place where futures contracts are traded.

A swap, like the name suggests, is swapping benefits of a party’s financial instrument for the others’. It is not a replacement business finance mechanism, but rather a win-win business finance mechanism. Here too, the forecasted value of the underlying is taken into account.

A swap, like the name suggests, is swapping benefits of a party’s financial instrument for the others’. It is not a replacement business finance mechanism, but rather a win-win business finance mechanism. Here too, the forecasted value of the underlying is taken into account.

Option is another derivative that establishes a non-obligatory contract to buy or sell an asset within a timeframe, and at an agreed price. Options have expiration dates. Within the expiration date trade has to happen. After this date, the option is closed for no other business finance activity.

Indian Bond Market

- Image via Wikipedia

The bond market is called the debt market. In this market, business finance traders trade bonds. In real sense, a bond is a kind of security for a debt taken. Issuers (borrowers) of the bond will be liable to repay the holders of it. Interest needs to be paid until the bond reaches maturity. After this, the principal of the bond needs to be paid. So in other words, a bond can be classified as a kind of loan.

More than equity markets, the bond market is sought by the business finance community all over the world. But in India this has not been the case. However, things have changed in India over the last decade or so. After the financial reforms in 1992, the bond market started to make progress. Banks were asked to drop off a part of their mediation in the financial markets. Ecosystem of the market was set as the control system; which meant that the market was not dictated by the government and national banks. In the early 1990′s old government securities were put under the hammer. Ending the era of rehearsed interest rates, the financial reform ushered in a fresh wave of business finance management. On account of this, demand and supply of business finance was the controlling factor in the bond market.

There are different types of bond markets in India. They are namely, corporate bond market, funding bond market, municipal bond market, and government bond market. Systems like delivery versus payment in the Indian bond market, ensures smooth settlement of outstanding business finance issues. The reserve bank of India has created a controlling system called the trade for trade system. Under this system no settlement other than bonds or funds are used to close bond transaction. Foreign investors with business finance of up to thirty percent as fixed income can now invest in the bond market in India.

There have been a slew of other measures taken by the government of India, to enhance the workings of the Indian bond market. The bond market in India has got enormous business finance potential.

Business Finance Analytics

- Image by Getty Images via@daylife

Sometimes business finance strategies fall on inert soil. By non-judicious use of business finance, things might go asunder. An approach that incorporates setting objectives to key stakeholders like employees, can work in large businesses. Stakeholders can be made to understand the end results of their performances. So it is important to make them understand the directives. If given the right business finance decision making system, financial performance can be bettered. This is what business finance analytics aims to achieve.

Financial analytics is high on popularity. Business finance information is the most important driver for sound decision making. With so many markets around, it is quite difficult to manage compliance tasks as well. Financial institutions were the first users of finance analytic techniques. Analyzing cash flows, research on equity participation, conduction feasibility studies on mergers and acquisitions are some of the areas that financial analytics delves into.

Financial analytics is a process by which internal and external business finance information is leveraged to produce business intelligence reports. Information will have plenty of pointers to it, most being action plans. India is being eyed as a potential vendor for cost-effective and super-efficient financial analytics. Companies are in the process of identifying existing outsourcing vendors and analyzing their capabilities for this activity.

Financial analytics is a process by which internal and external business finance information is leveraged to produce business intelligence reports. Information will have plenty of pointers to it, most being action plans. India is being eyed as a potential vendor for cost-effective and super-efficient financial analytics. Companies are in the process of identifying existing outsourcing vendors and analyzing their capabilities for this activity.

Financial analytics is the domain of educated business finance professional like chartered accountants, and statistics graduates. Other financially-educated personnel are used as well. A popular business finance study program is the Chartered Financial Analyst (CFA) course being offered by many educational institutions in India.

Globally, the financial analytics market is huge. Touching more than 5 billion US dollars in market potential, it’s the next wave of financial outsourcing opportunity for India to capitalize on. Now all that India has to do is to try to get business finance professional to bite the bait of a highly rewarding career. Often, new avenues are viewed with suspicion in India. Stemming from lack of governmental initiative towards marketing new outsourcing avenues, educated graduates turn down non-established careers. But now the situation has changed. India has risen to business finance analytics in a big way.

Business Finance Investments in IT: Role of IT Service Management

- Image by pittigliani2005 via Flickr

Total cost of ownership is a concept that shows an asset’s real worth. People make the mistake of basing an assets business finance worth on its contract values. Cost potential arises from a variety of possibilities that the asset might be subject to. Even difficult is to calculate the return of business finance investment. Investment values and asset values can be derived from the return-of-investment (ROI) indicator. But ROI sometimes ignores the costs associated with invested business finance.

IT infrastructure costs are constant. Technology upheavals are not overnight affairs. They take time, resources, and sound business finance investment discretion. Many a times, in the mundane chore of carrying out IT tasks, experimentation is kept on the backburner. Controllable as it might seem, IT costs on normal infrastructure maintenance and repair is never assessed for a cost recovery. Presumably, IT business finance theorists feel that IT costs can be reined when the need arises.

So how can a mechanism be established that controls and balances out IT costs? Measures for this are still out in the desert. Considering that IT costs are never in the scheme of things of business finance returns on investment.

In organizations, managements fail to understand the direct and indirect benefits of business finance investments in some areas. IT is one of those. IT is most often than not seen as a support activity. Business finance revenue is not directly attributed to its presence or absence. Now perspectives are changing with the inclusion of IT Service Management (ITSM) in the scheme of things. IT service management deals with the management of IT infrastructure. More on the customer-centricity front, ITSM seeks to map IT directly to business goals.

In organizations, managements fail to understand the direct and indirect benefits of business finance investments in some areas. IT is one of those. IT is most often than not seen as a support activity. Business finance revenue is not directly attributed to its presence or absence. Now perspectives are changing with the inclusion of IT Service Management (ITSM) in the scheme of things. IT service management deals with the management of IT infrastructure. More on the customer-centricity front, ITSM seeks to map IT directly to business goals.

ITSM allows companies to make more purpose-driven business finance investments. Competitive advantage being built notwithstanding, companies now can crisscross roads of business with the roads of IT. By doing this, companies will arrive at business finance cost models that leverage the linking up of IT with drivers of business goals.

Therefore, ITSM seems to be an excellent choice for companies to standardize their IT business finance decision making.

Microfinance in India

- Image by Getty Images via@daylife

Microfinance is offering business finance to low-income groups. It is a series of small-portioned finance capsules. In India, business finance in micro-capsules makes sense, given the vast amounts of under-financed sectors. Many classes of the society have absolutely no access to business finance avenues. Microfinance was born, to defeat this situation.

In India, microfinance has enabled women to be self-employed. Even though business finance was delivered, the span was limited. Due to lack of knowledge, and lack of business finance providers in this category, microfinance didn’t pick pace. Microfinance still remains a flapping bird, unable to fly.

Although microfinance is a terminology used now to associate it with a business finance lending strategy, microfinance has always existed before. Post-independence, the Indian government directed banks to give business finance to priority sectors like agriculture. Loans on concessional rates were given to farmers and peasants during that time. Statistically, South Asian countries account for most of the micro-business finance consumption. World Bank estimates have it that close to ninety percent of India’s population has no access to any kind of business finance.

Lack of proper organization of these loans, still vested the microfinance power to the corrupt moneylender. Charging unruly interest rates, the money lender capitalized on the helplessness of the cattle class people of India. But now things are changing. People are awakening to the realities of microfinance.

Many microfinance institutions have been setup in India. Life and survival promotion organizations like BASIX were the first ones. Other microfinance institutions (MFIs) followed suit. Most MFIs were NGOs. They all came with an orientation to uplift the poor. But problems started happening when the oil well of microfinance was discovered, and perspectives started changing.

Some basic methodologies adopted by MFIs to solve business finance issues of clients are to use a poverty survey to identify potential areas to target. Then, debts of all people are clubbed together by getting them to form groups. A wholesome loan is given against the debt without collateral, and each debt-member has to pay his/her debt. By doing this the repayment of the debt is eased out.

Understanding Liquidity Risk

- Image via Wikipedia

In business finance, any security/asset/investment that has a good salability value has less liquidity risk. Anything that can be easily realized as money in less time is a highly liquid asset. Assets that are not highly liquefiable have high liquidity risk. Though simple in definition, understanding liquidity risk is like a universe. It is vast, and sometimes unsubstantiated.

When the odds looks stacked against a business, it might be forced to go for asset liquefaction. Inability to sell assets sets-in when the market is down. This situation is that of stubborn market liquidity. In the same vein, when a business approaches banks to bail it out and the banks go asunder, then it experiences stubborn financial liquidity. When talking in terms of banks; any bank that can raise business finance from its own kitty is said to have a low liquidity risk.

To tackle liquidity risk, there are some methods adopted by business finance vendors like banks, investment companies, and venture funds. In risk management, liquidity risk has a low occurrence rate. Reputational liquidity risk is another version of liquidity risk that limits business finance for companies based on factors like reputation. Stress tests need to be conducted to expose a business’s capacity to generate business finance when it is needed the most. Based on the results, plans have to be drawn up to factor-in any predicted situations.

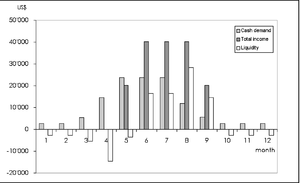

Analyzing and quantifying the long-term run-up of an asset is important. Asset-life assessments reveal the longevity and flexibility of an investment-class that provides ample support to last a business. Business finance forecasts or cash flow projections are another way to assess liquidity risks. Prediction mechanisms have to be established that predict the future behavior of cash flows. In this way, the availability or non-availability of cash can be determined during a time frame.

Understanding liquidity risk in business finance is important. Investor and customer confidence being the prerogative in these times, businesses have to predict, and preempt business finance situations. Though methodologies are not well developed to counter liquidity risk, all it requires initially is some basic business common sense.

Infrastructure Finance in India

- Image by seaview99 via Flickr

India’s robust growth during the recent decades can be attributed to infrastructure finance. Leading the developing countries list, India is growing at a rate of over 8 percent GDP. Business finance institutions have been instrumental in providing the financial support in the infrastructure space. Infrastructure needs to be complemented with business finance resources. But India has been well supported with business finance for infrastructure development activities.

Approving the inclusion of business finance in the infrastructure space, the government is laying a lot of impetus on the importance of the role of infrastructure finance companies. That’s specifically the reason why the eleventh five year plan of the Indian government foresees business finance investments in infrastructure to the tune of twenty crores plus. Directing the planning commission to encourage private business finance investment in infrastructure, the prime minister’s office has laid its objective clearly.

With the auguring of non-banking finance companies, the situation looks even better. Business finance in infrastructure will be given support by the Reserve Bank of India, which has developed specialized policy compartment for it. Infrastructure needs these special entities to fund exorbitant amounts that are difficult to raise in the market.

Infrastructure Financing Companies that have good credit ratings and over 300 crores in funds are given the go-ahead. Now that the Reserve Bank of India has made provisions to infrastructure finance companies, business finance in infrastructure will get more thrust.

Infrastructure Financing Companies that have good credit ratings and over 300 crores in funds are given the go-ahead. Now that the Reserve Bank of India has made provisions to infrastructure finance companies, business finance in infrastructure will get more thrust.

Borrowers for business finance can expect to get more finance, since infrastructure companies can legally mobilize more than a quarter of its funds. This might not be over-leveraging, but does add more flexibility to the scheme of things in business finance. Single-group multiple borrowings can take more than forty percent over existing funds from infrastructure companies.

Infrastructure finance thrives on funds that have been invested for longer periods of time. Though individual investments are tough to come by, institutions like the World Bank and the Asian Development Bank are providing able assistance. Teaming up with these institutions, the government is ensuring long term investments in infrastructure.

No comments:

Post a Comment